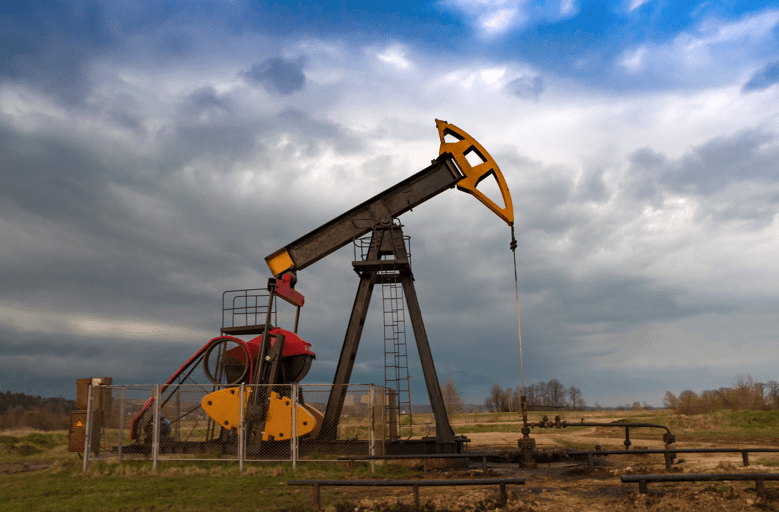

Are Mineral Rights a Good Investment?

Are you researching mineral rights and wondering if they are a good investment? You are not alone. Trying to navigate the complexities of mineral rights, tax implications, and the selling/buying process is not easy. It is our attempt, however, to make it easier but providing some essential information such as:

Reasons to Buy Mineral Rights,

Benefits that Mineral Rights Bring,

Risks of Buying Mineral Rights

Finding the Right Advisors Before you Make a Decision

Keep reading to get insights on how best to approach buying mineral rights and get informed before making any decisions. Let’s start.

Reasons to Buy Mineral Rights

- You can make a good return on your investment

- Buying mineral rights is a way to support the American economy

- Mineral rights are passed down through generations

- Buying mineral rights can give you peace of mind

When it comes to investing in mineral rights, there are several compelling reasons to do so. Buying mineral rights is a way to invest in natural resources. As demand for these resources grows, so does mineral rights’ price. This makes purchasing mineral rights a sound investment that can offer good returns.

In addition, buying mineral rights is a way to support the American economy. The mining industry significantly contributes to the country’s GDP and provides millions of jobs. Buying mineral rights helps to ensure that this important industry continues to thrive.

Benefits that Mineral Rights Bring

Tax Benefits, Increased Property Value, and More

When it comes to investing in mineral rights, there are several benefits that you could enjoy. For instance, if you own the mineral rights to a piece of property, you may want certain tax benefits. Additionally, the value of your property is likely to increase if there are minerals present.

Of course, there are also some risks associated with owning mineral rights. For instance, if you don’t own the surface rights to the land, you may not be able to access the minerals. Additionally, extracting minerals can be a costly and time-consuming process.

Before you make any decisions about investing in mineral rights, it’s essential to do your research and speak with a professional. This way, you can make an informed decision about whether or not this type of investment is right for you.

Risks Involved in Buying Mineral Rights

Many people are keen to invest in mineral rights, but there are a few risks before making any decisions. Buying mineral rights can be a speculative investment, and the value of the minerals may not be known for years. There is also the risk that the minerals may never be extracted or that the extraction costs may be higher than expected.

There are a few ways to mitigate these risks, however. Working with experienced mineral rights companies is crucial, they will offer you advice if you are selling mineral rights or keeping them. It is also worth researching the area before making any decisions.

Finding the Right Advisors Before Making a Decision

At Blue Flame Minerals, we have been in the business since 2011 and know the complexities of mineral rights investment. Our reliable team will walk you through the process so that you can make the appropriate decision for you and your family. We also offer informed advice for those going through difficult ownership. Contact us today for professional advice and learn the process of mineral rights investment.